Accounting is a notification of a manager’s management ability

Accounting is an important element of corporate management. If management continues to neglect accounting operations, it will lead to a deterioration in productivity and profitability, which in turn will lead to a deterioration and depletion of cash flow and bankruptcy. Such a vicious cycle can be prevented by analyzing financial indicators carefully and having a proper grasp of the business condition.

MACK Consultants Group provides total support for improve and develop corporate management on monthly bookkeeping and management advice

Accounting Services

月次巡回監査

専門スタッフが各月お客様の下へお伺いし、記帳内容の確認、指導し、正確な月次決算を可能にします。

また、月次決算の内容をもとに経営長所報告書を作成し、数字の説明と経営状況のアドバイスを行なっています。

記帳代行・自計化支援

記帳業務を忘れていた…。そのまま数ヶ月溜めてしまい、慌てて領収書と格闘!こんな経験ありませんか?

会社の数字をリアルタイムに把握するためには、日々の記帳業務が大切です。記帳のことでお悩みの方はお問い合わせください。

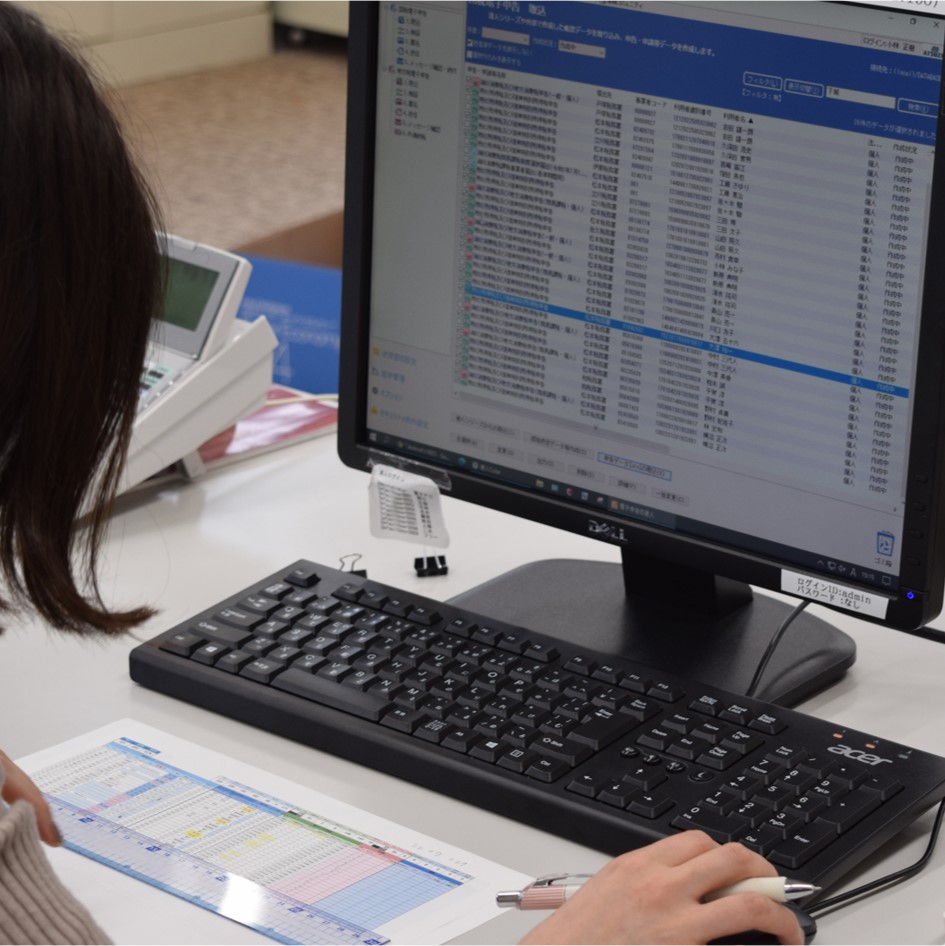

その他にも、自社で会計業務を行いたい方に向けた自計化支援も行なっています。

分野別会計

医業や建設、農業、宗教法人、財団法人、学校法人等、一般の業種とは異なる会計処理が必要になります。

MACKコンサルタンツグループは、このような分野ごとの会計や許認可制度の違いに対応しています。「うちの会計は自分たちでやるしかない……。」そう悩む前に一度ご相談ください。

確定申告・制度会計

確定申告、年末調整などの税務会計はお任せください。MACKコンサルタンツグループでは、税務申告の際に「税理士法33条の2添付書面」をつけています。

Difference between Institutional and Management Accounting

There are two types of accounting services: institutional accounting, which is mandatory, and management accounting, which is voluntary for companies. Both types of accounting are essential for running a company, but many managers are only aware of institutional accounting. A limited number of managers have adopted management accounting.

Here are some employees who can teach you the difference between these institutional and management accounting methods.

A. Senior veteran of 15 years with the company.

B. Three years with the company. Still a greeny.

B: A client asked me to explain the difference between institutional and management accounting! I couldn’t explain it well….

A: It can’t be helped. Now, let me explain again the difference between institutional accounting and management accounting.

When I explain this to my clients, I tell them that “institutional accounting is the numbers of the past” and “management accounting is the numbers that create the future.

Institutional accounting records what has happened to the company up to now.

Institutional accounting is an accounting method used for the purpose of calculating, reporting, and disclosing past facts to shareholders, banks, tax offices, and other interested parties, which ultimately results in a financial statement.

By the way, do you remember some types of institutional accounting?

B: Let’s see, there are two kinds of accounting, financial accounting and tax accounting, right?

A: That’s right, the first is financial accounting, which is used to report a company’s financial situation and operating results to its stakeholders. The second is tax accounting, which is used to calculate taxable income and pay taxes in accordance with tax laws.

It is this institutional accounting that most people think of when they hear the word “accounting”. Institutional accounting allows a company to clarify its business performance and financial position, such as what the company has spent for management and how much sales it has made.

Since this institutional accounting is mandatory for a company, many managers emphasize institutional accounting.

Management accounting is accounting for the future of the company

B: I understand the importance of institutional accounting, but then what purpose does management accounting serve?

A: Management accounting is an accounting method used to control the management of a company. In contrast to institutional accounting, which is intended for reporting and disclosure to third parties, the purpose of management accounting is to improve management. In other words, it is a decision-making tool for managers to consider what to do to increase sales and reduce costs.

Also, unlike institutional accounting, management accounting has no fixed rules or format, so it can be implemented according to rules that vary from company to company.

B: Do you mean that each company has a different accounting method?

A: Yes. For example, there are differences in the methods of analyzing marginal profit margin and break-even point. The appropriate ratio of labor cost and material cost differs depending on the type of industry and business.

In contrast to institutional accounting, which is based on laws and other rules, management accounting involves a variety of accounting methods. Therefore, it is important to select an accounting method that is appropriate for the company’s financial condition, business situation, and type of business. Management accounting also enables an accurate grasp of business conditions and the early detection of management issues, as well as the ability to make business decisions with marginal profit in mind.

How can we make a profit from our sales? The answer is, Management accounting makes it easier to set management goals and training plans for employees. If issues are found and addressed, profits will increase, and losses will decrease.

B: So, while it’s not mandatory, it’s an essential accounting for the company to grow!

A: That’s right.

B: I now understand the difference between institutional accounting and management accounting. Thank you for the explanation!

Accounting that controls the actual status of the company

If accounting is not done properly, the company may end up paying taxes that it does not have to pay, or it may miss taxes that it does have to pay, which could be considered tax evasion and result in additional taxes. Not only that, but it may also lead to loss of trust from business partners and society.

Accounting not only prevents these problems, but also helps to identify the causes of losses and clarify sales targets to make a profit.

MACK Consultants Group also recommends that accounting operations be performed in-house. This is because it enables a real-time grasp of the company’s business situation and makes it possible to make accurate management decisions.

However, there are cases in which it is difficult to perform in-house accounting. In such cases, we propose bookkeeping services.

If you are overwhelmed with daily business and before you know it, your receipts and invoices are scattered all over the place, you do not have time to do bookkeeping, or you do not have an accountant, we can do it for you.

Please feel free to contact us if you have any problems with invoices, receipts, financial statements, or any other accounting tasks.